A multi-peril crop insurance product that provides a safety net for all commodities on the farm under one insurance policy.

Whole-Farm Revenue Protection (WFRP) is a multi-peril crop insurance product that provides a safety net for all commodities on the farm under one insurance policy, including specialty and organic crops, allowing for more crop diversity on the farm.

WFRP provides protection against loss of revenue that you expect to earn or will obtain from commodities you produce or purchase for resale during the insurance period.

WFRP is designed to meet the needs of highly diverse farms that are growing a wide range of commodities, and for farms selling commodities to wholesale markets. The WFRP policy was specifically developed for farms that tend to sell to direct, local or regional, and farm-identity preserved markets and grow specialty crops.

WFRP Coverage

How Does It Work?

- WFRP provides protection against loss of revenue that you expect to earn or will obtain from commodities you produce.

- WFRP can be a stand-alone policy or purchased in conjunction with other buy-up level crop insurance policies (YP, RP, RP-HPE and CAT policies).

- Certain documents are required for WFRP. Examples include five consecutive years of Schedule F or other farm tax forms. Your FMH agent can advise which documents are needed for coverage eligibility.

What Are the Benefits?

- Meets the needs of highly diverse farms that are growing a wide range of commodities.

- If two or more commodities significantly contribute to the operation, you will receive a whole-farm subsidy on your premium.

- Coverage levels range from 50% - 85%, allowing diverse farms to get similar coverage to other buy-up policies.

- Provides replant coverage, except Industrial Hemp and products covered by another federal crop insurance policy.

WFRP Insured Revenue

WFRP insured revenue is the total amount of insurance coverage provided by this policy. Your agent and FMH determine the farm’s approved revenue using the following information:

- Whole-Farm History Report

- Farm Operation Report

- Information regarding growth of the farm

Downloads & Resources

Coverage Level

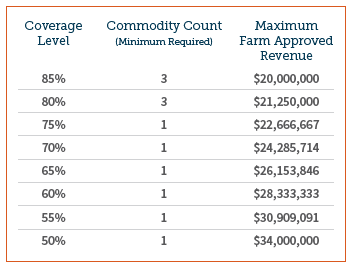

The farm’s insured revenue amount is the coverage level you choose (50-85 percent) multiplied by your farm’s approved revenue.

The commodity count in the table above is a measure of the farm’s diversification, determined by the policy. The calculation determines the minimum proportion of revenue a commodity must contribute to the farm to be considered a commodity for WFRP. A farm’s revenue would be evenly distributed if an equal percentage of revenue came from each commodity produced.

For example, a farm’s revenue comes 25 percent from corn, 25 percent from soybeans, 25 percent from spinach, and 25 percent from carrots. The minimum proportion to be considered a countable commodity is one-third of that amount. In this example, for corn, soybeans, spinach, or carrots in each county, each commodity would have to make up at least 8.3 percent of the total revenue of the farm to count as a commodity under WFRP. Commodities with revenue below the minimum are grouped together to recognize farm diversification (this makes the commodity count higher). The maximum farm-approved revenue represents the maximum approved revenue for a farm to be eligible for WFRP given the $34 million maximum liability allowed.

Additional Information

Premium Subsidy

If you have two or more commodities that significantly contribute to your operation, you will receive a whole-farm subsidy. If not, you will receive the an Enterprise Unit premium subsidy.

Causes of Loss

Whole-Farm Revenue Protection provides protection against the loss of insured revenue due to an unavoidable natural cause of loss that occurs during the insurance period and also provides carryover loss coverage if you are insured the following year. See the policy for a list of covered causes of loss.

Losses Under a WFRP Policy

At the end of the insurance period and after you have filed your farm income taxes for the insurance year, a loss adjuster will complete an Allowable Revenue and Allowable Expense Worksheet for the insurance year using your farm tax forms. First, the allowable expenses will be compared to your approved expenses to determine if you incurred at least 70 percent of your approved expenses. If you did not, then your insured revenue will be adjusted downwards by one percent for each percent you are below 70 percent of your approved expenses.

The allowable revenue will be adjusted for inventory adjustments, unharvested or unsold production, and production you lost for uncovered causes of loss to determine the revenue-tocount for the year. A loss is paid when the total revenue-to-count for the insurance year falls below the insured amount of revenue, multiplied by the expense reduction factor, if applicable.

The Sales Closing Date, Cancellation Date, and Termination Date are specific to your county. The date is either January 31, February 28, March 15, or Nov. 20*. The Sales Closing Date for Micro Farm is 30 days after your county's spring Sales Closing Date. Ask your FMH agent to learn more.

*The definition of a late fiscal filer includes producers with tax years that begin September through December. These producers have a November 20 Sales Closing Date.

Availability

Whole-Farm Revenue Protection is available in all counties in the FMH writing area.